News in 3-min

THIS WEEK’S TRENDS

Updated 4/8/24

Interest Rates (avg 30yr conv): 7.11%

Up m/m, up w/w

Mortgage rates peaked over 8% last week of October, and dropped to 6.5 late December, returning to ~7% - As expected in my forecast for the last year

https://www.mortgagenewsdaily.com/mortgage-rates/30-year-fixed

Open Houses

Attendance is up m/m, up w/w

Average 15 visitors each day, with limited new east side listings having >100/day, (colossal deviation between new vs old listings and Seattle vs Eastside)

Visitors are information gathering to start a Spring search - fewer visitors are speaking of waiting until Summer

Buyer Sentiments

Up m/m, up w/w

Some have hoped for higher interest rates to reduce buyer competition. Interest rates still generally trending down, most buyers looking forward to lower rates later this year but most know that buyer competition will increase with lower rates. Only some buyers understand that with more competition they will need more cash for escalations and “additional down for low appraisals”.

https://www.nwmls.com/high-interest-rates-continue-to-influence-inventory-and-growth/

Seller Sentiments

Up m/m, up w/w

Sellers are confident while some are playing it safe by waiting for the market to continue warming up. Lower interest rates indirectly result in more sellers entertaining their upsizing or downsizing goals but 78.7% of current homeowners have a sub-5% rate; 59.4% are sub-4. 2024 will have few people selling outside of necessity or major life changes, but more than last year.

Builder confidence is growing - beginning to remove incentives

General Consumer Sentiment

Up y/y; Up m/m (down m/m CCI)

Nov/Dec saw 29% increase (largest two-month gain since 1991); Continued increase through January to a 31-month high

http://www.sca.isr.umich.edu/. Also, visit: https://www.conference-board.org/topics/consumer-confidence

WoW

(market last week compared to the previous week)

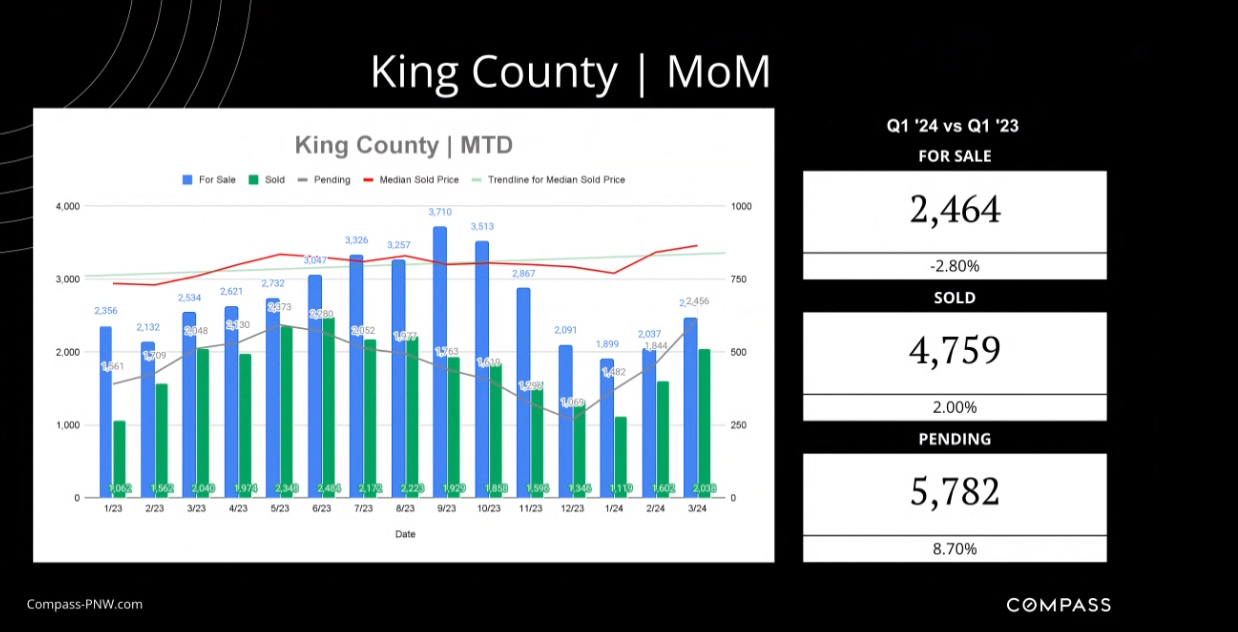

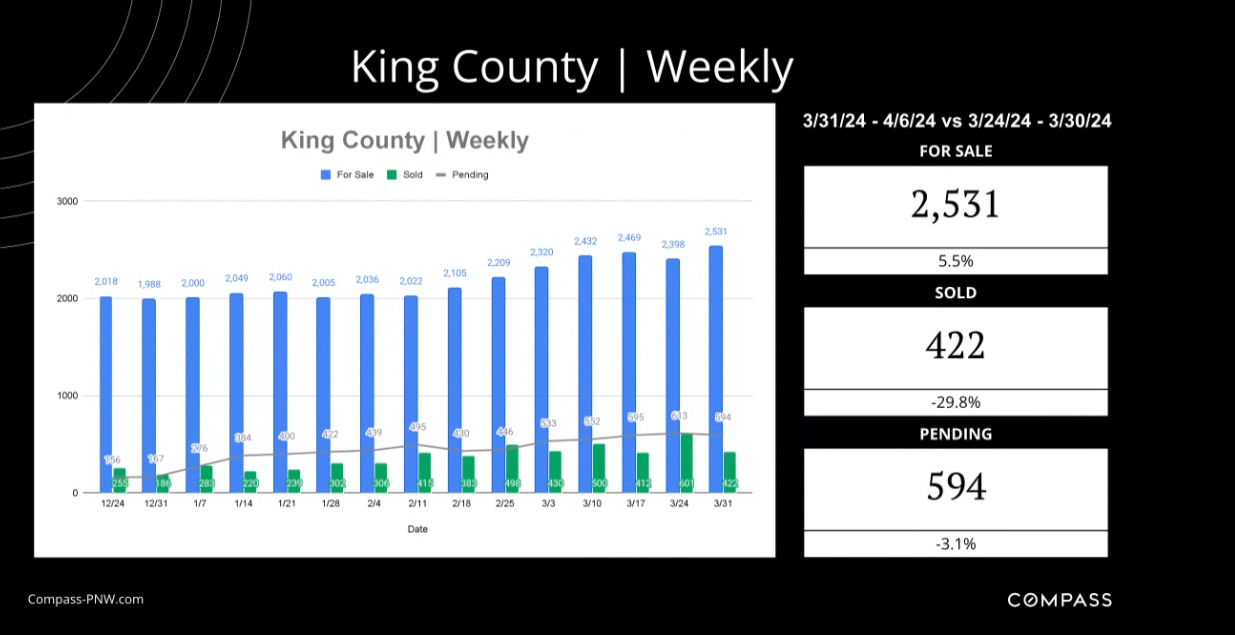

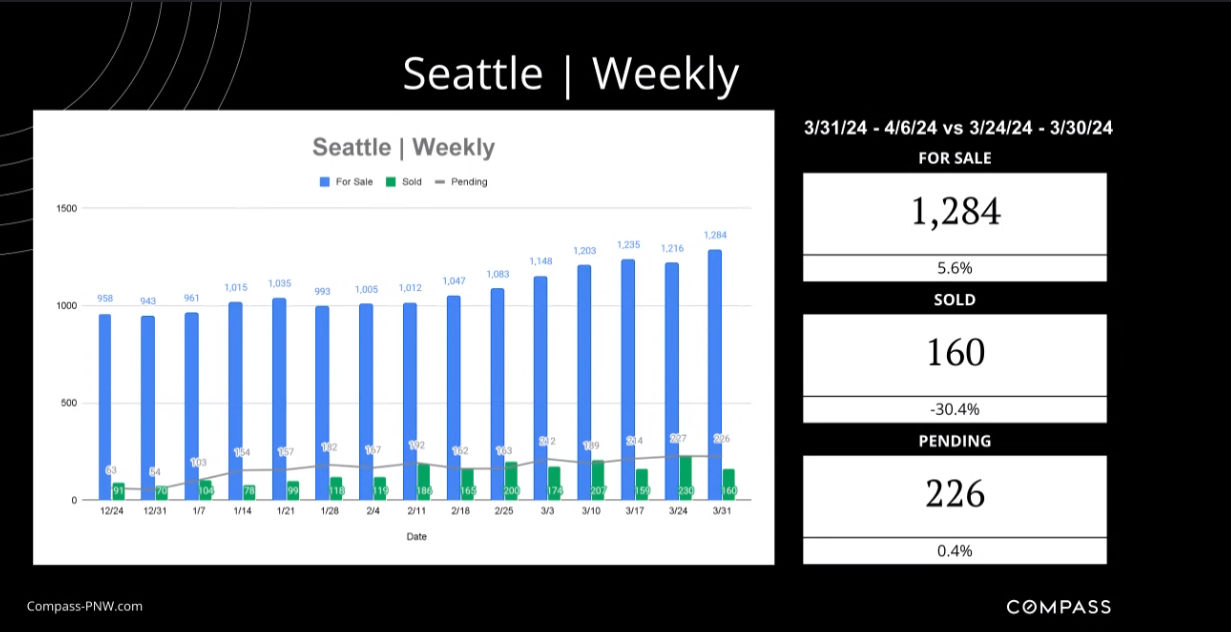

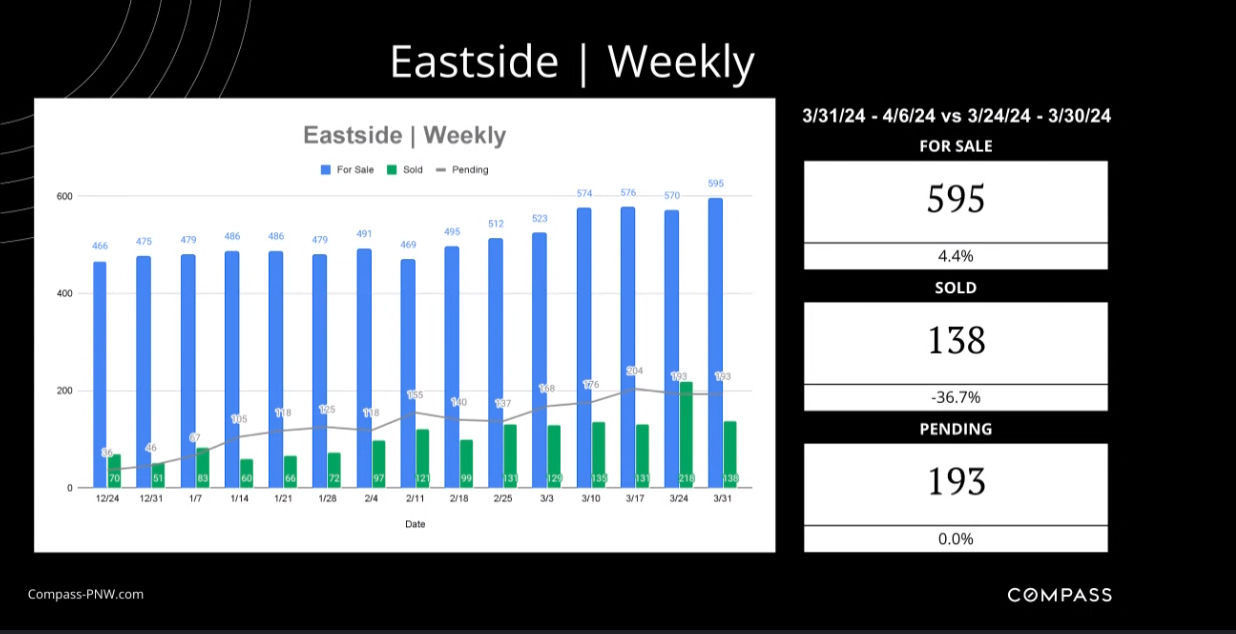

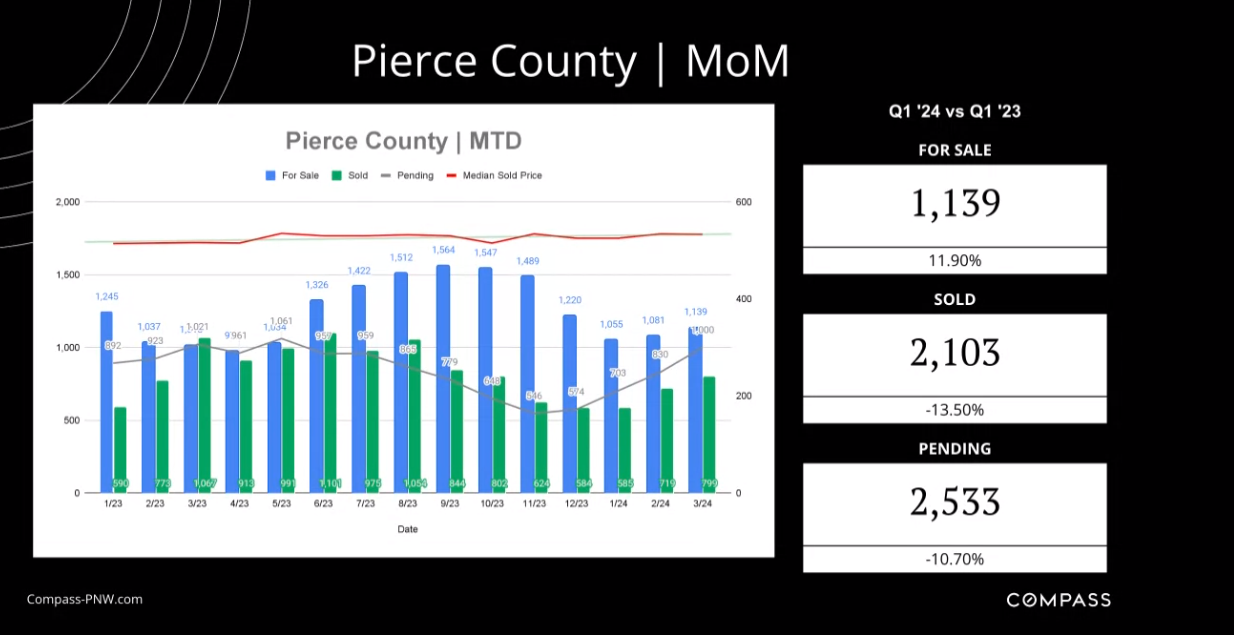

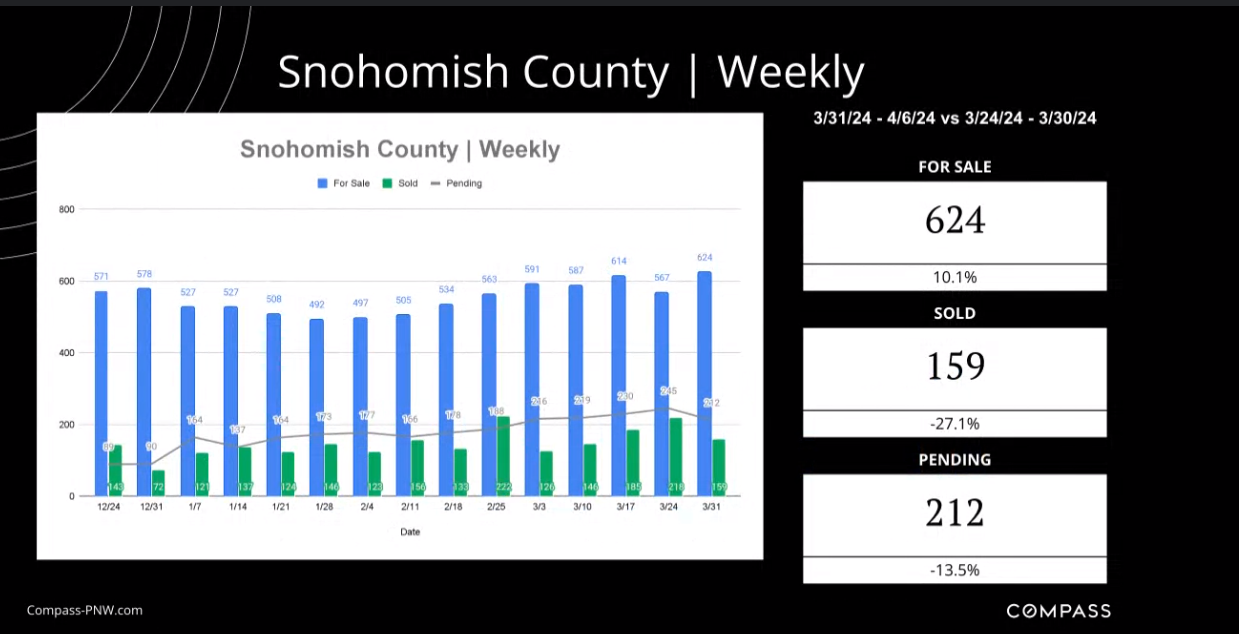

Due to traditional seasonality, we typically experience a slow down this time of year over the next week, and the market activity remained relatively stable despite slight drops in King County as a whole and the Eastside. Days on market continue to drop week over week, while the median active price remains stable and the median sale price rises.LAST WEEK'S UP TO DATE NUMBERS

CURRENT STATS

Average Days On Market and Median Active/Sold Prices

King County: DOM: 25 | Median Active Price: $850K | Median Sale Price: $930KSeattle: DOM: 24 | Median Active Price: $960K | Median Sale Price: $950K

Eastside: DOM: 20 | Median Active Price: $2.098M | Median Sale Price: $1.703M

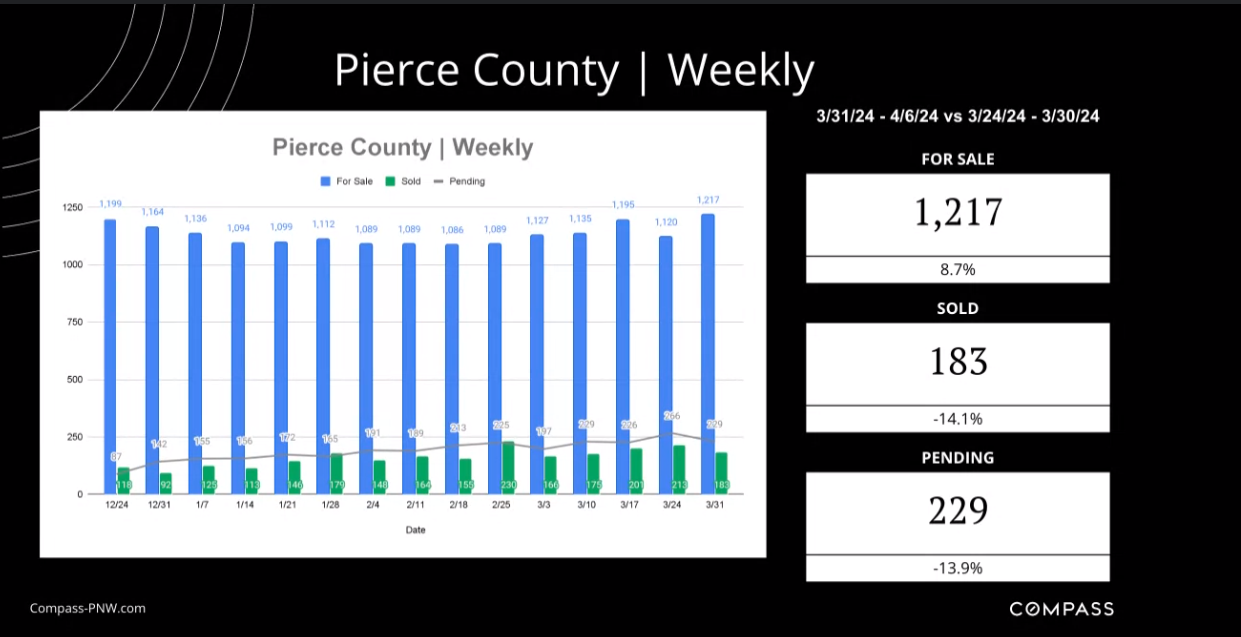

Pierce County: DOM: 35 | Median Active Price: $685K | Median Sale Price: $550K

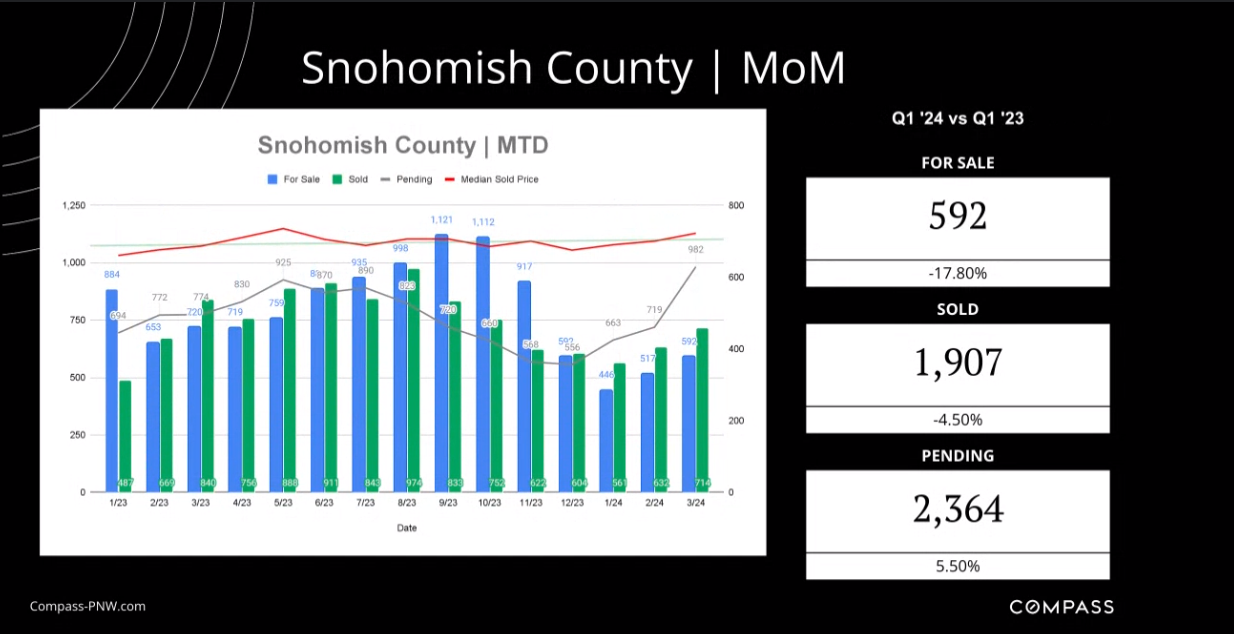

Snohomish County: DOM: 25 | Median Active Price: $835K | Median Sale Price: $751K

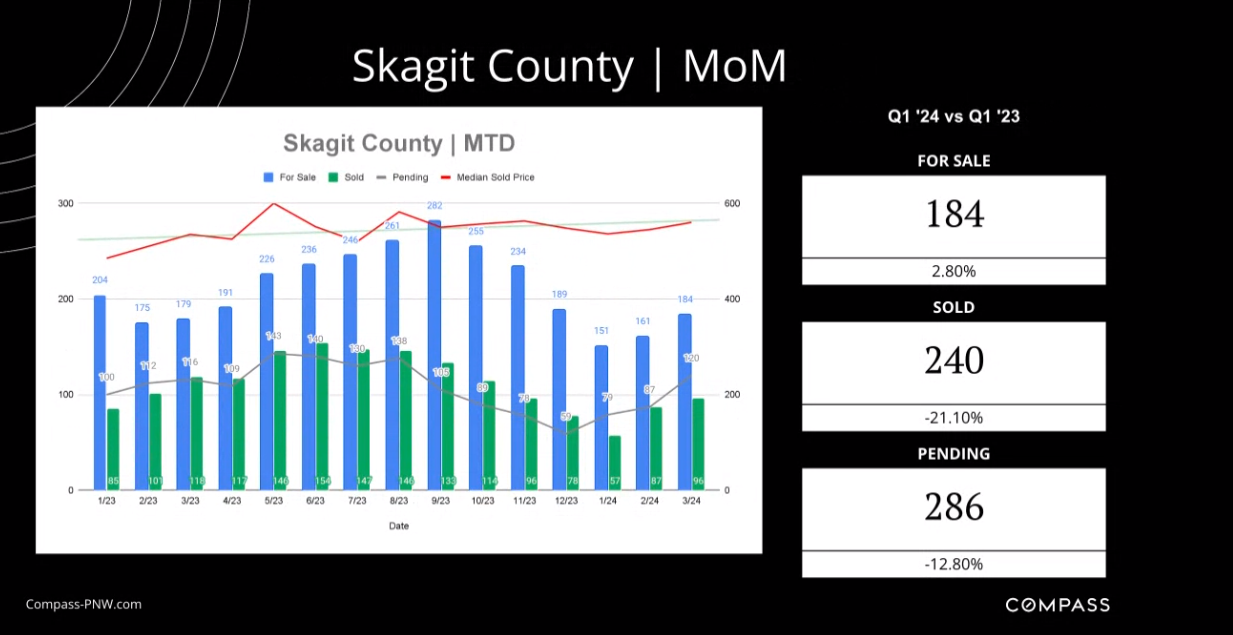

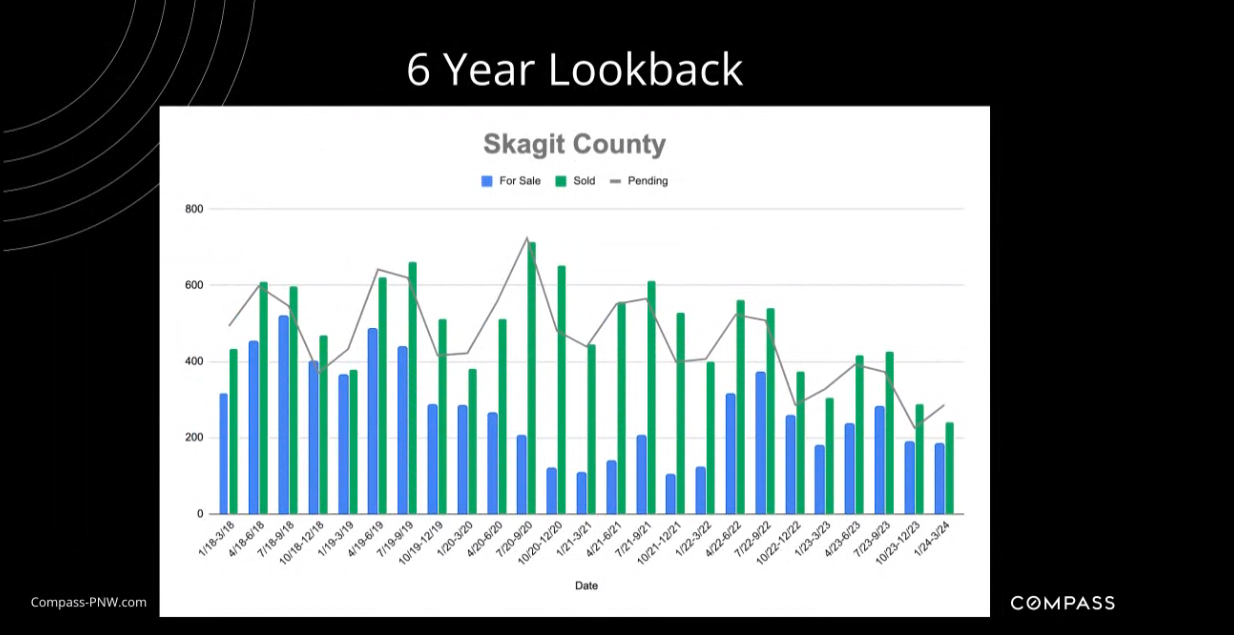

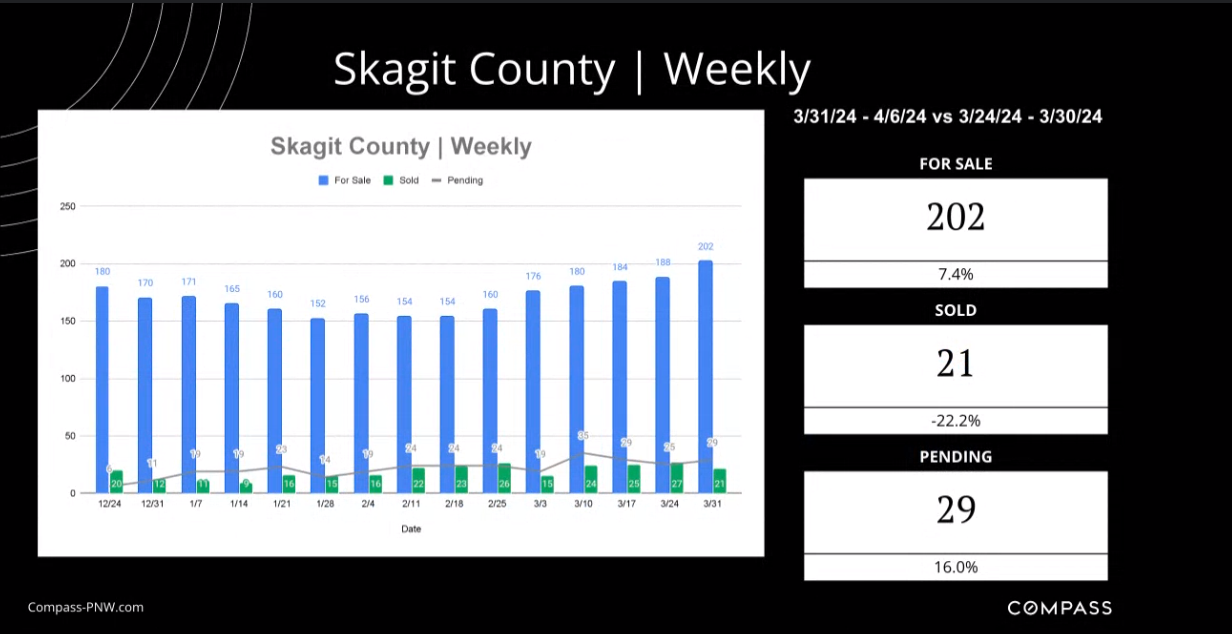

Skagit County: DOM: 58 | Median Active Price: $660K | Median Sale Price: $583K

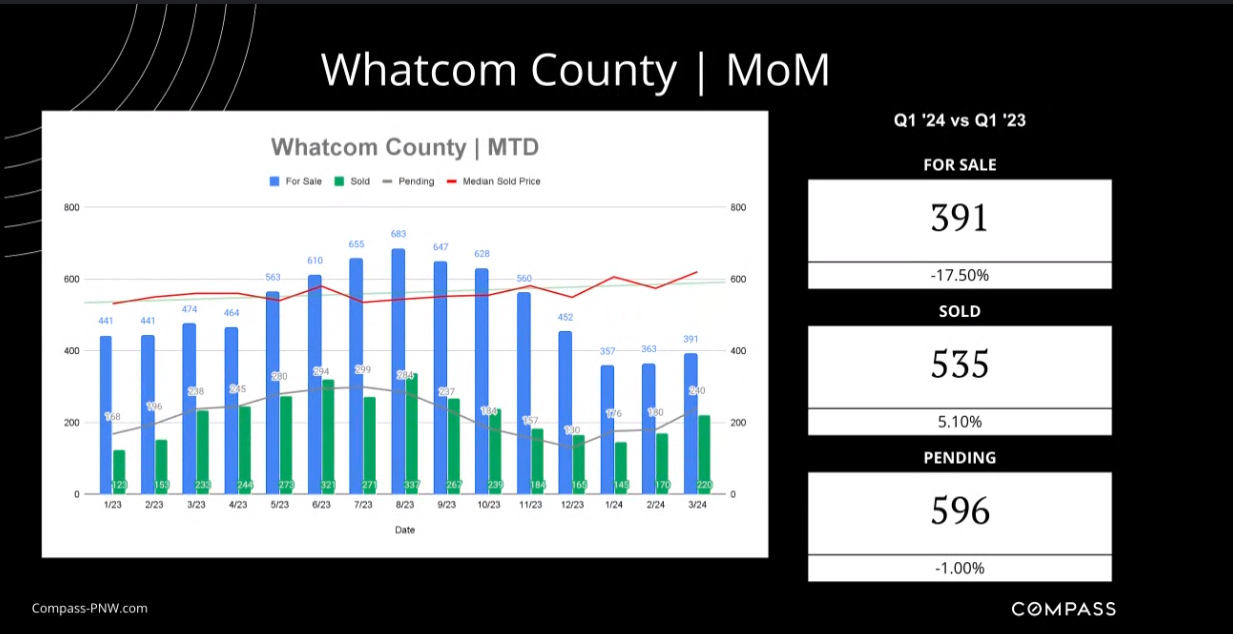

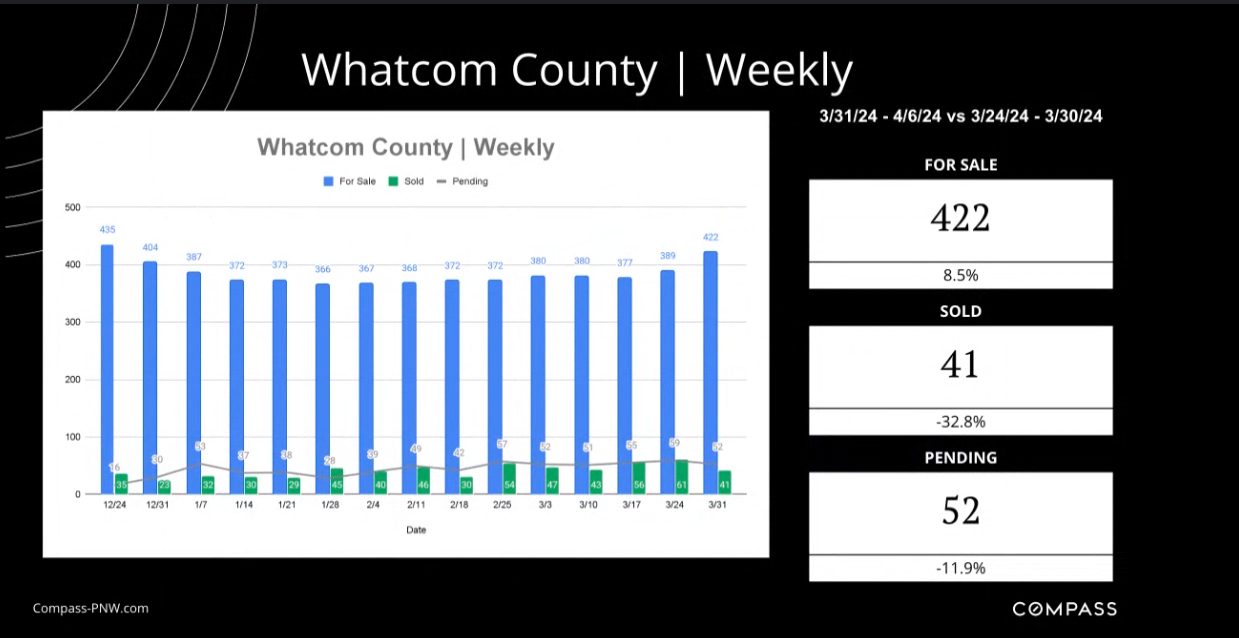

Whatcom County: DOM: 34 | Median Active Price: $685K | Median Sale Price: $577K

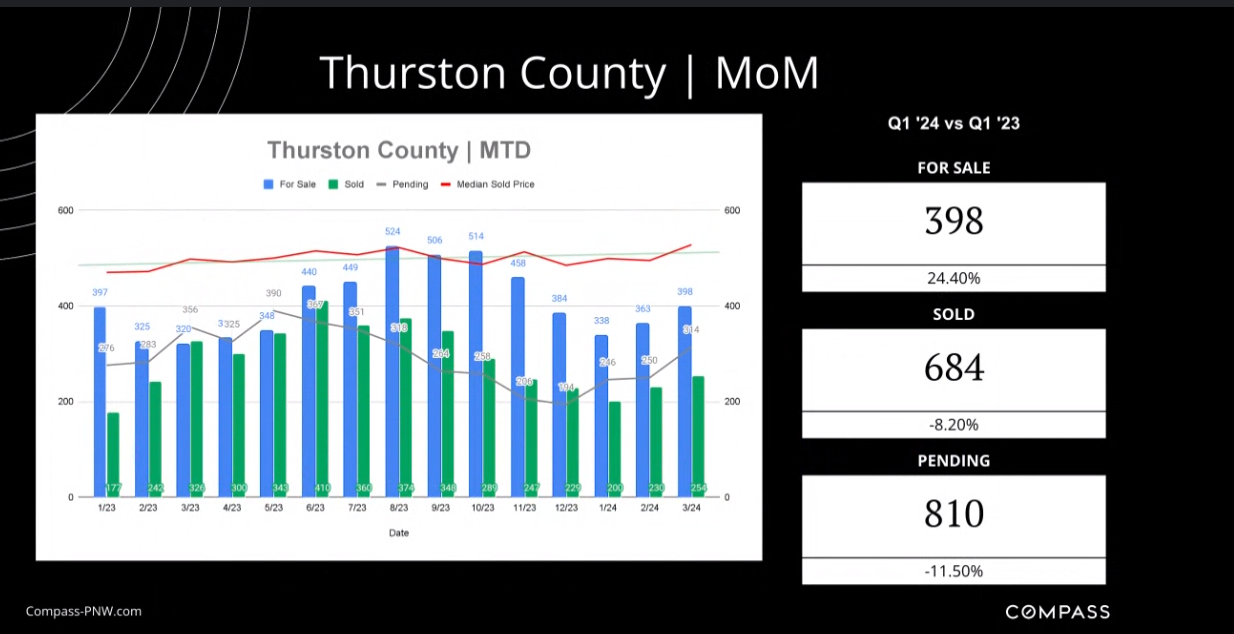

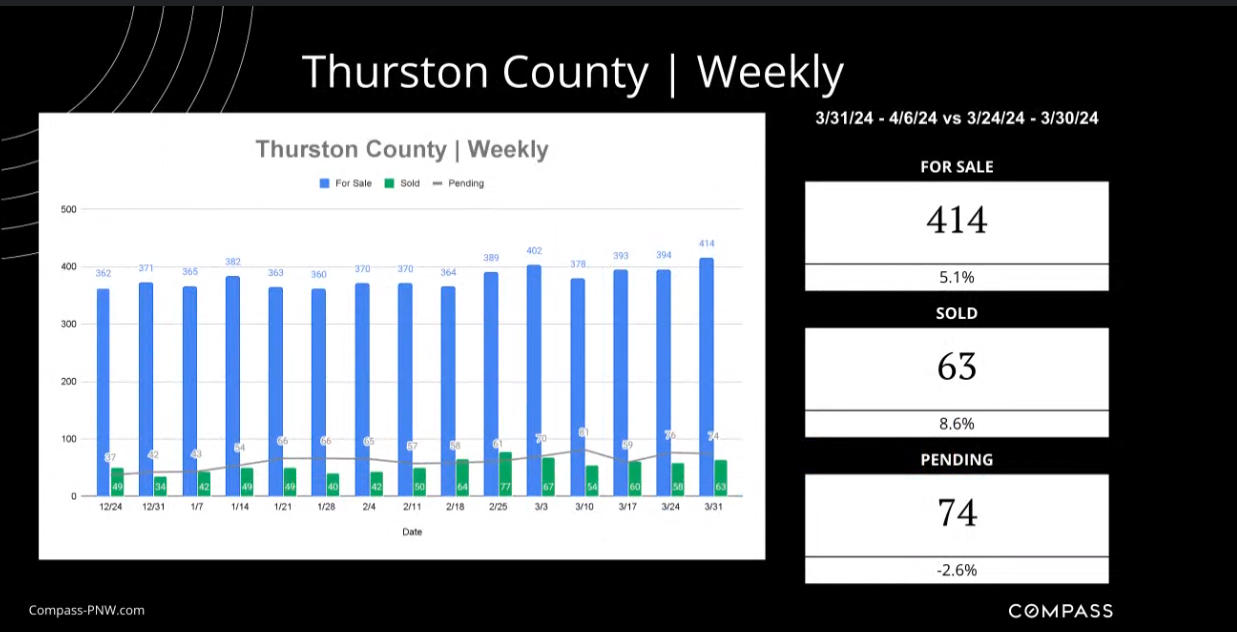

Thurston County: DOM: 40 | Median Active Price: $559K | Median Sale Price: $505K

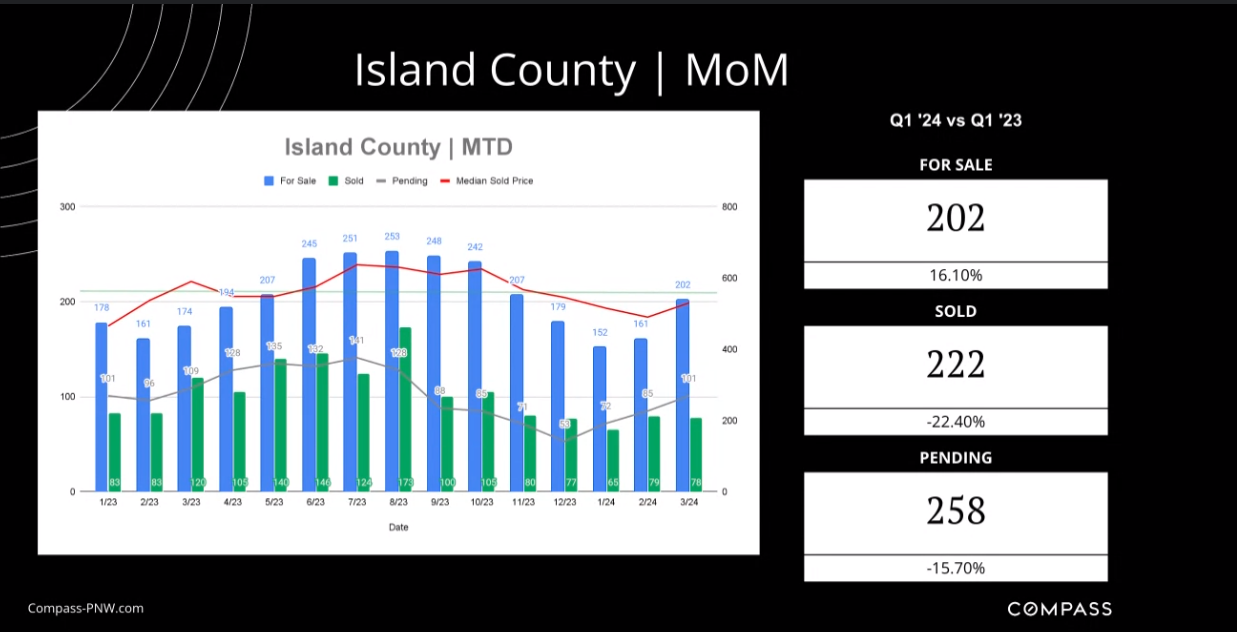

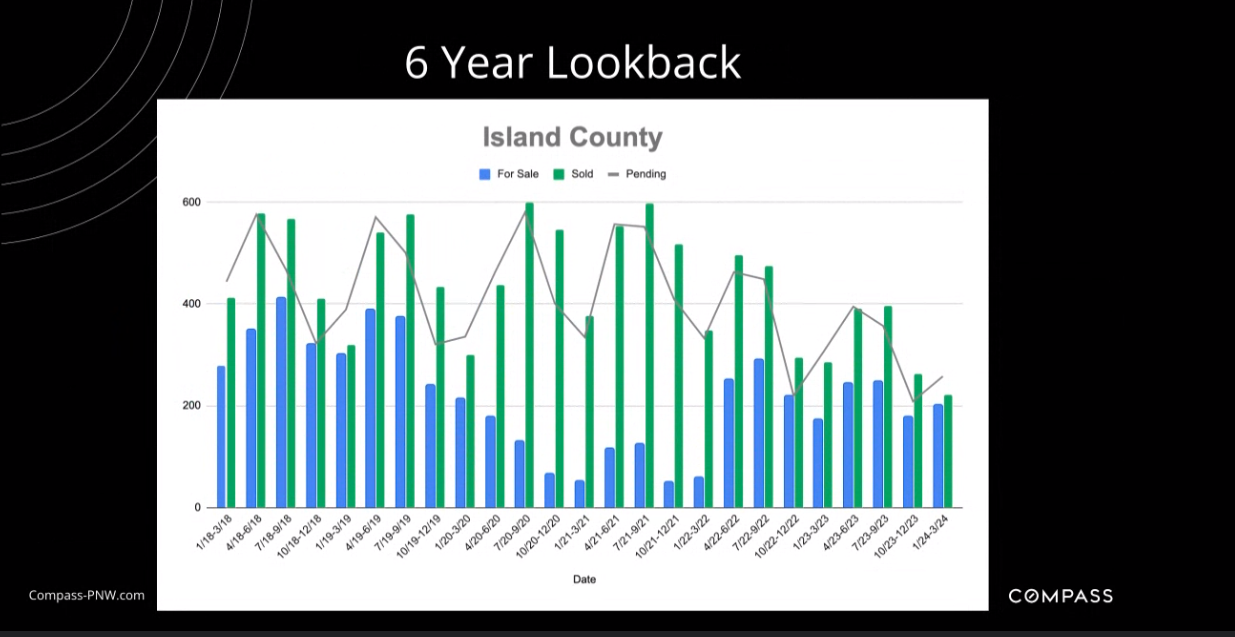

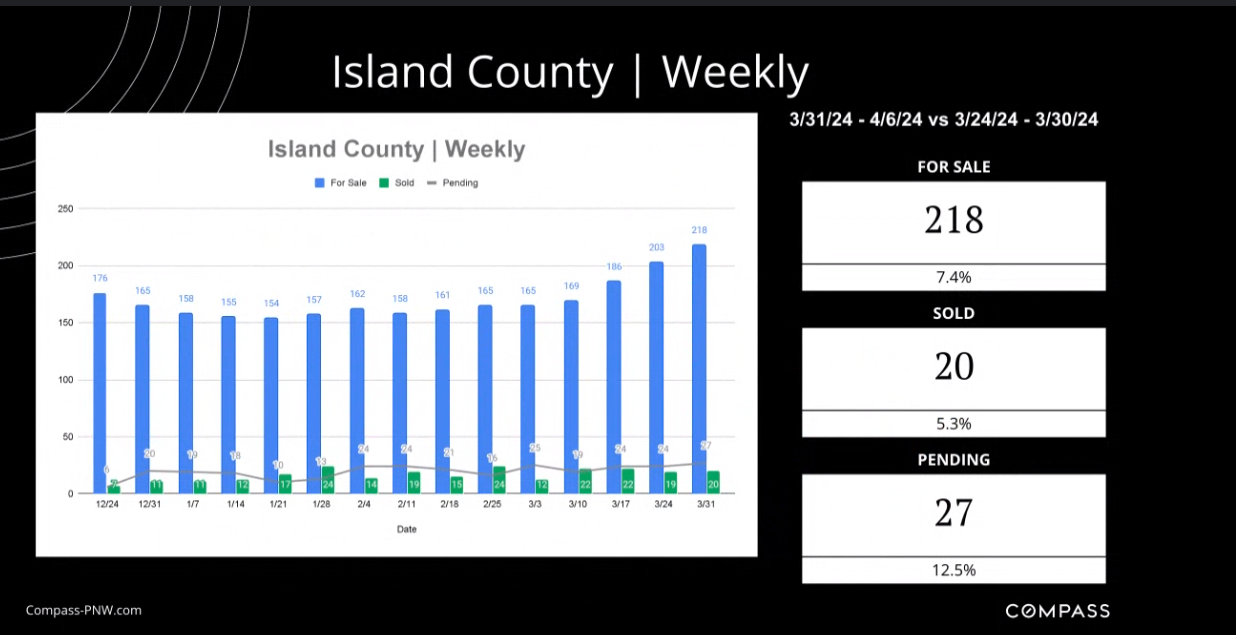

Island County: DOM: 28 | Median Active Price: $749K | Median Sale Price: $538K

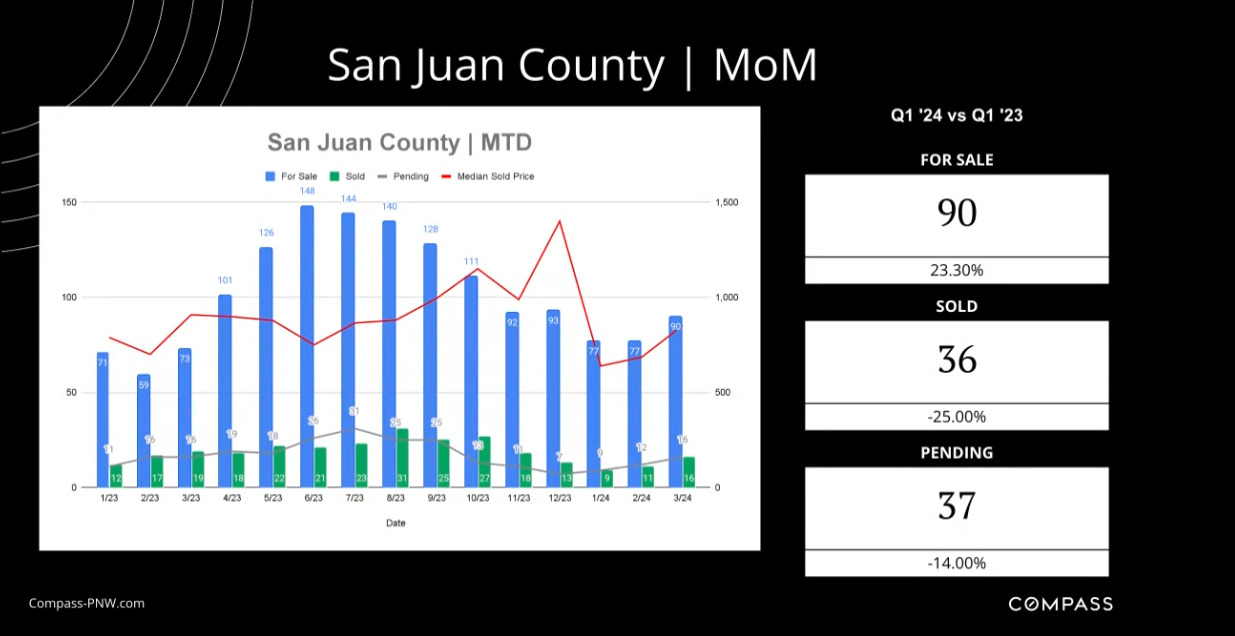

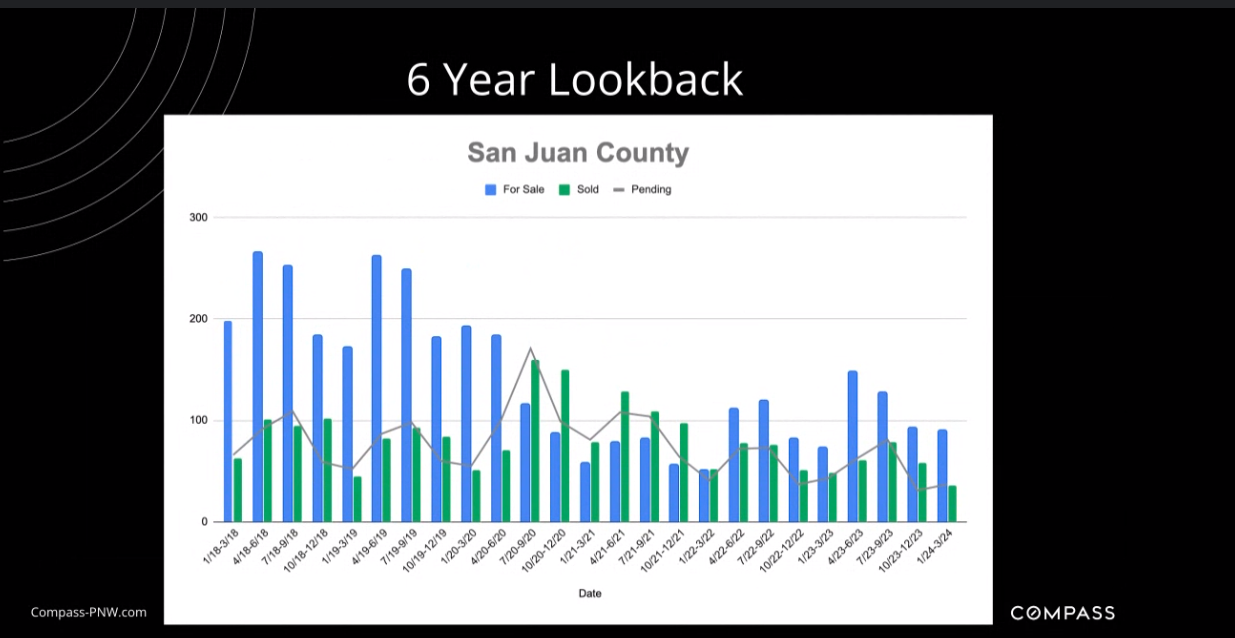

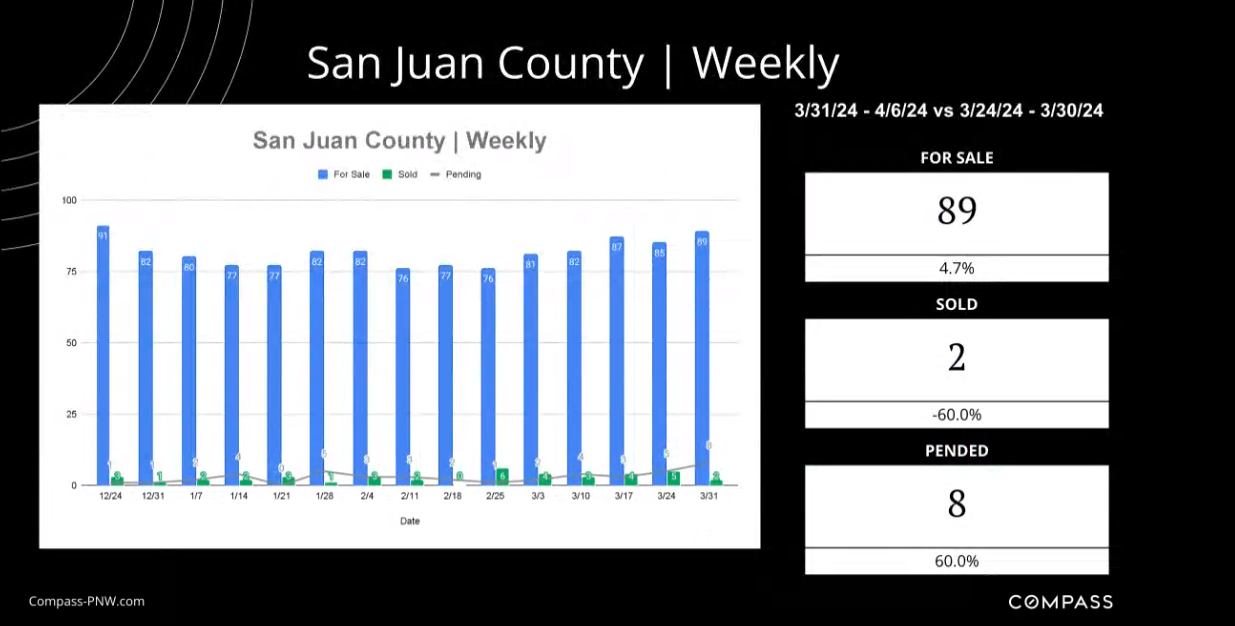

San Juan County: DOM: 103 | Median Active Price: $1.150M | Median Sale Price: $715K

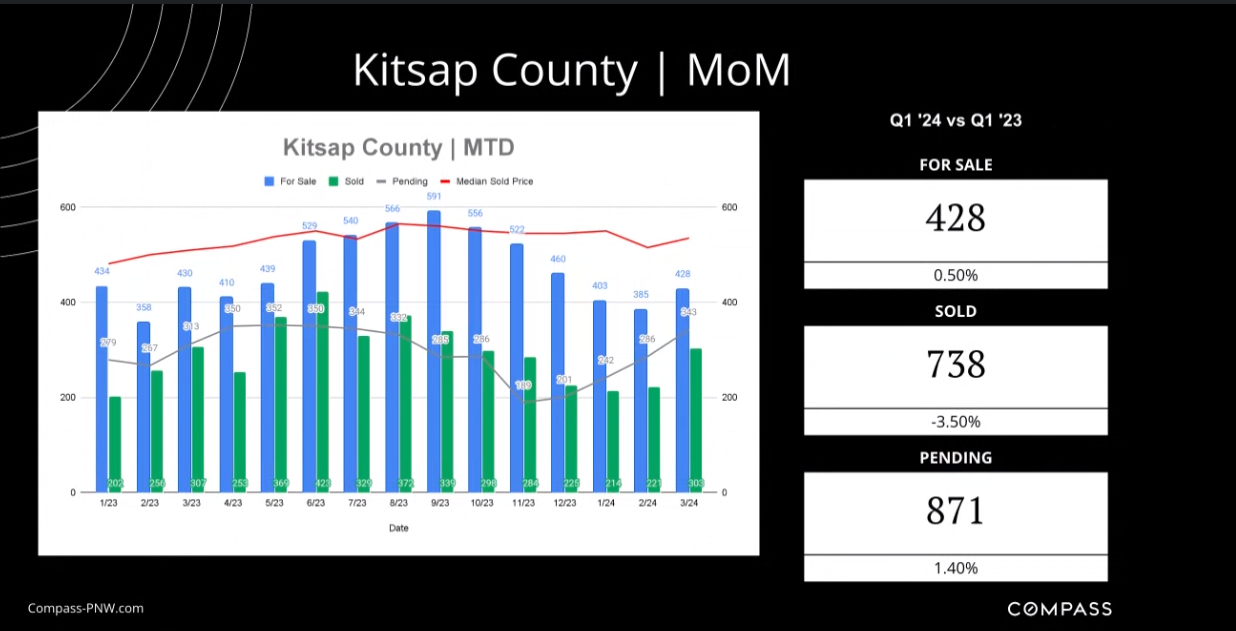

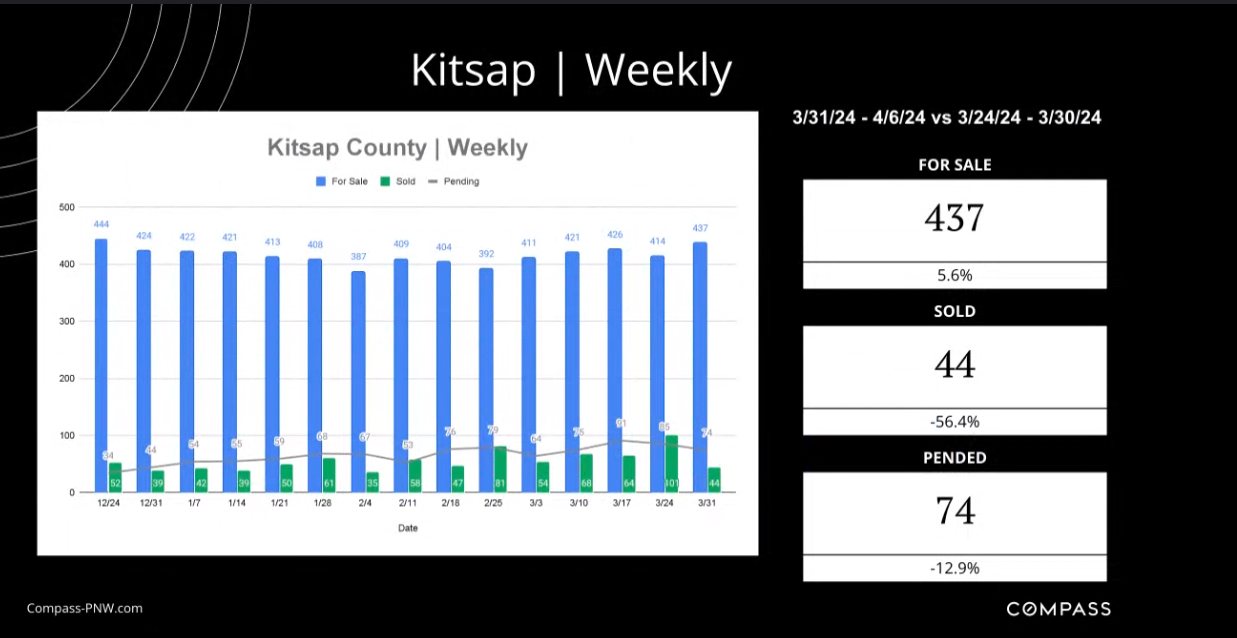

Kitsap County: DOM: 36 | Median Active Price: $650K | Median Sale Price: $558K

New Listings (NWMLS March): 8,028 up 1.6% YoY

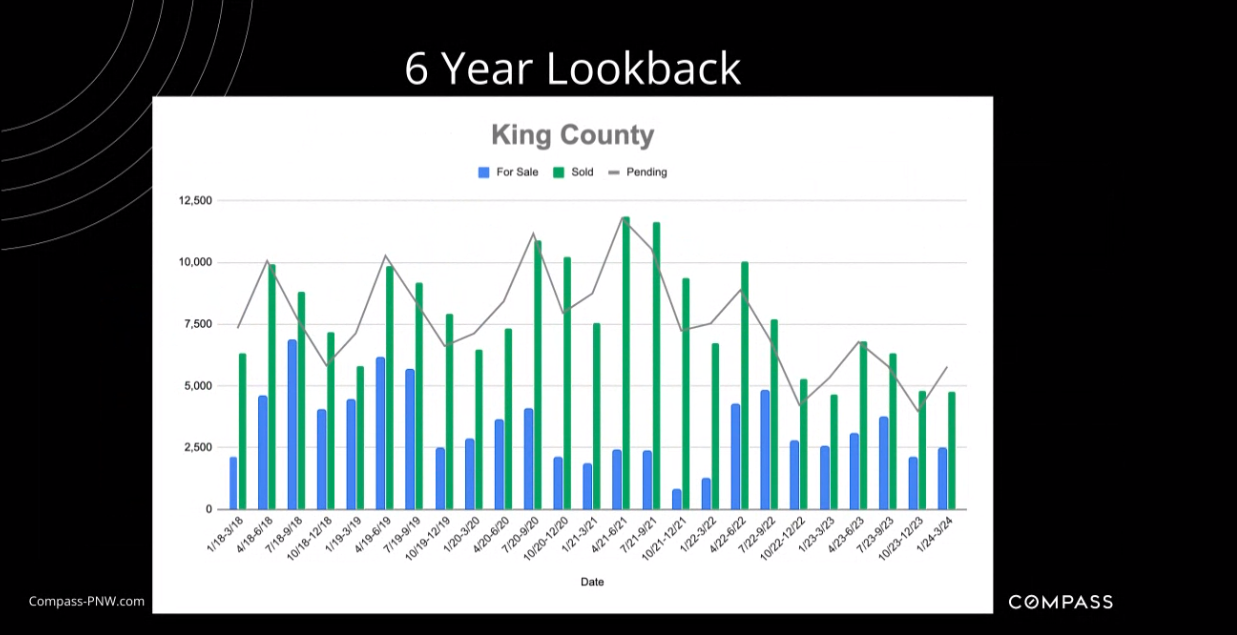

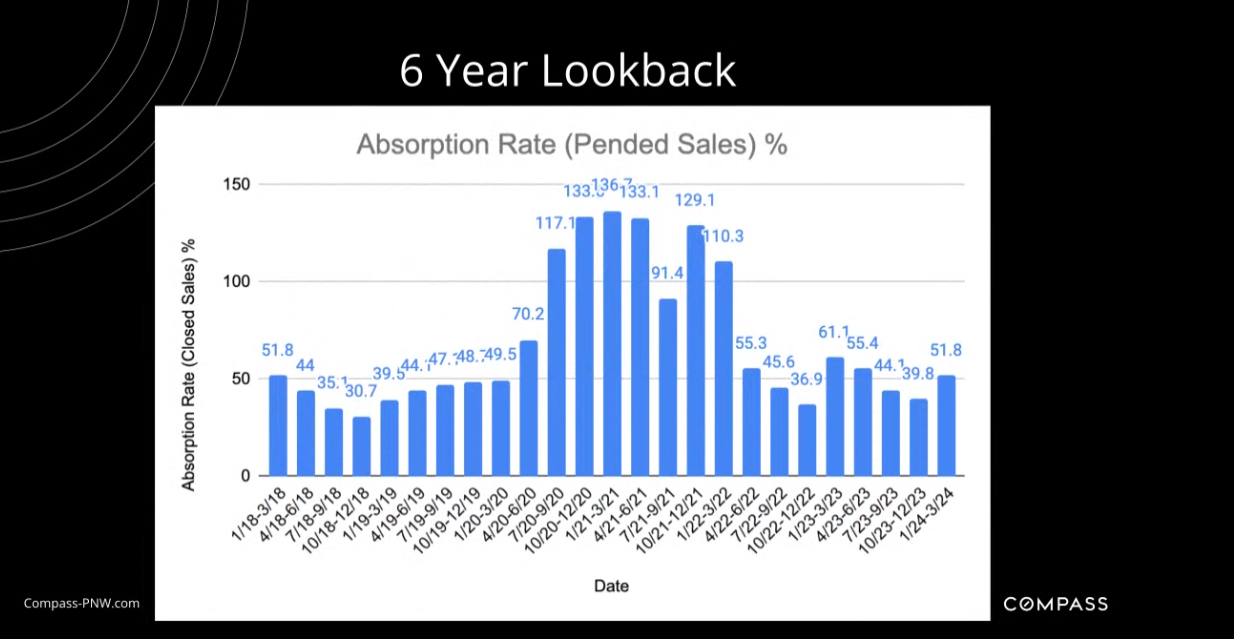

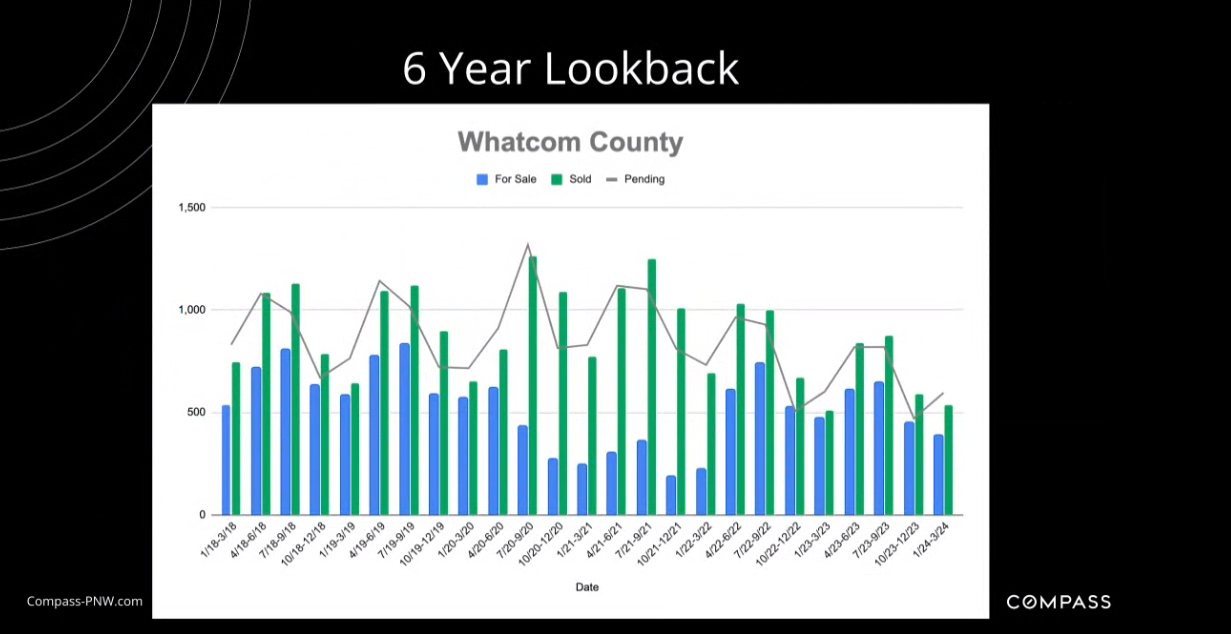

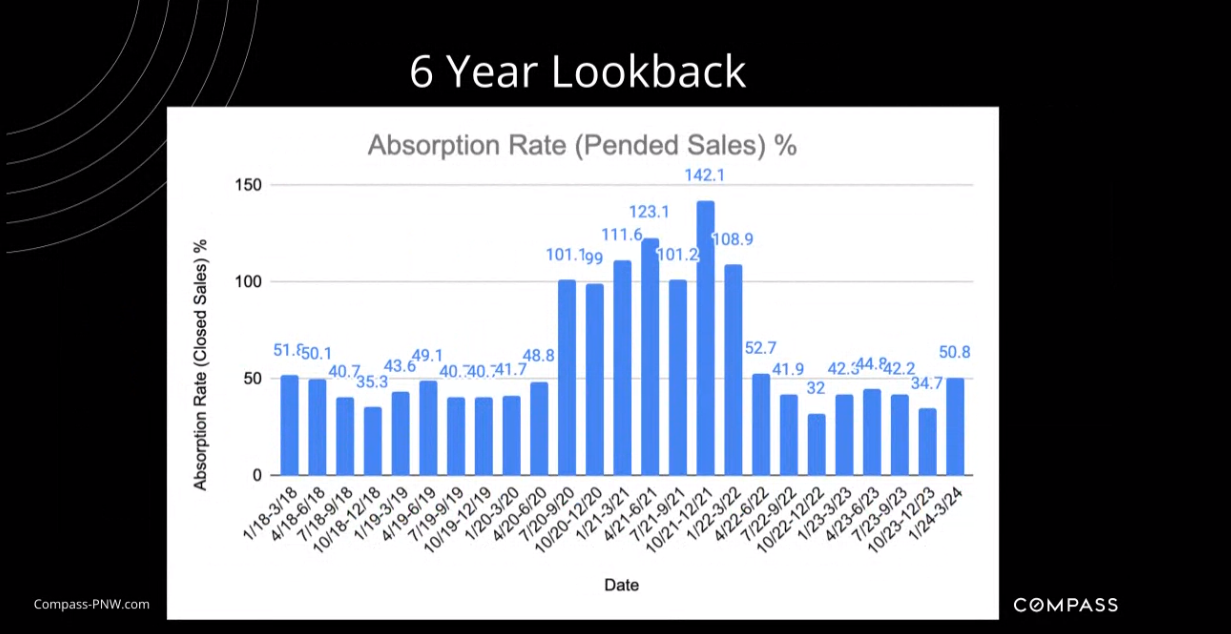

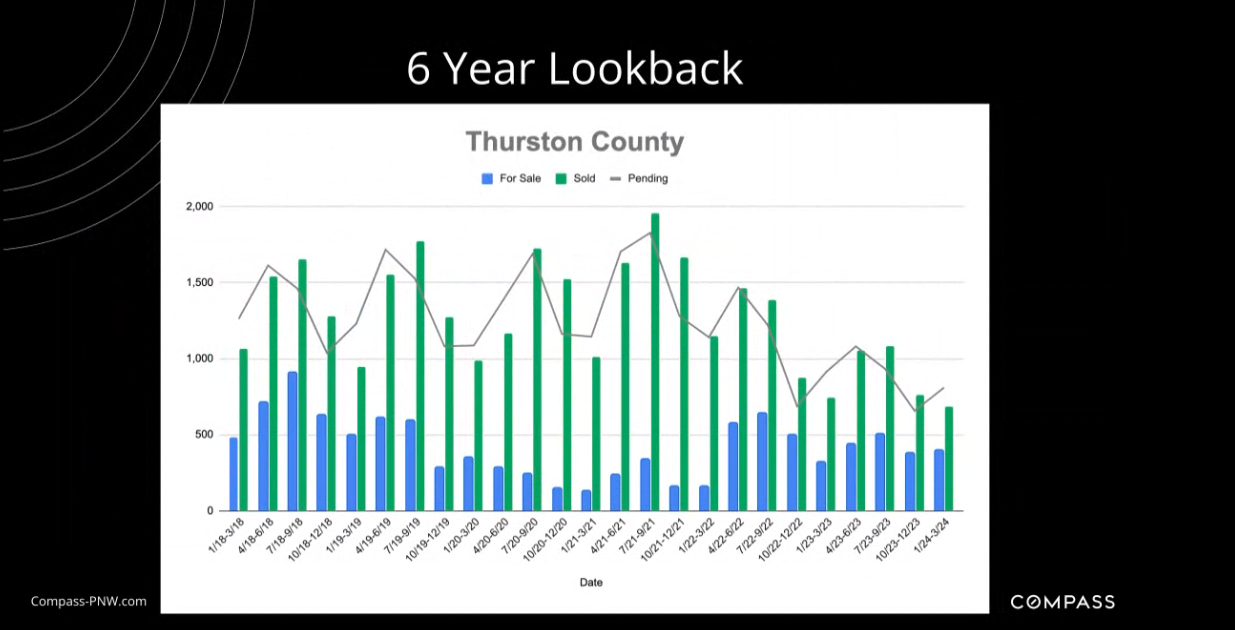

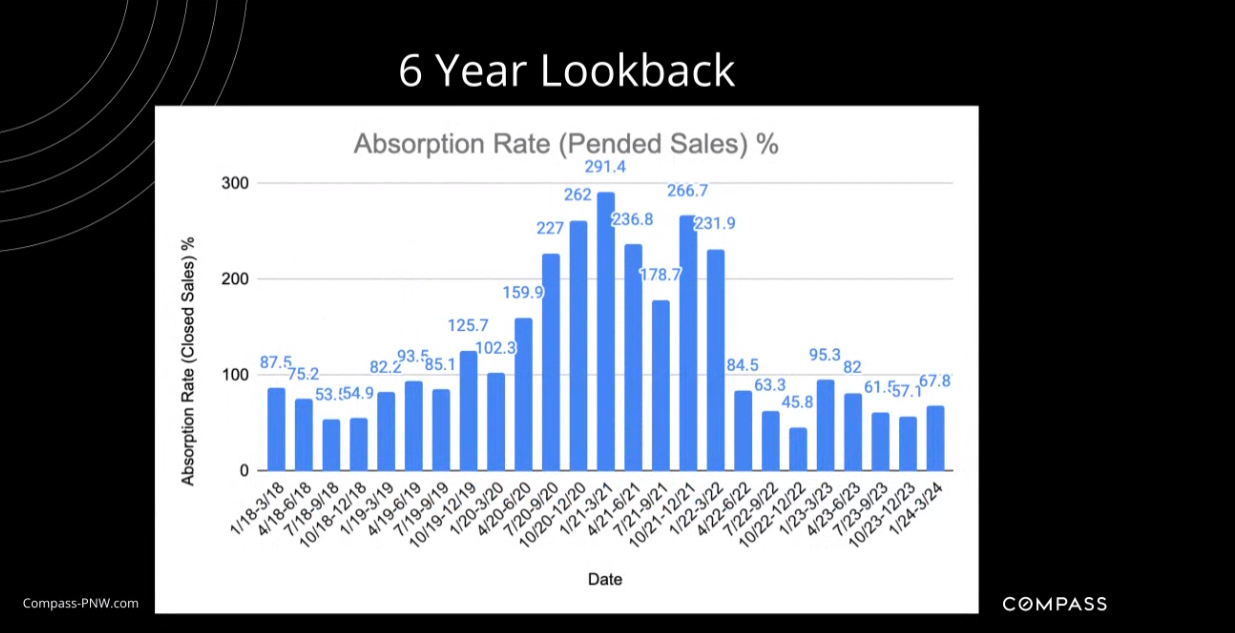

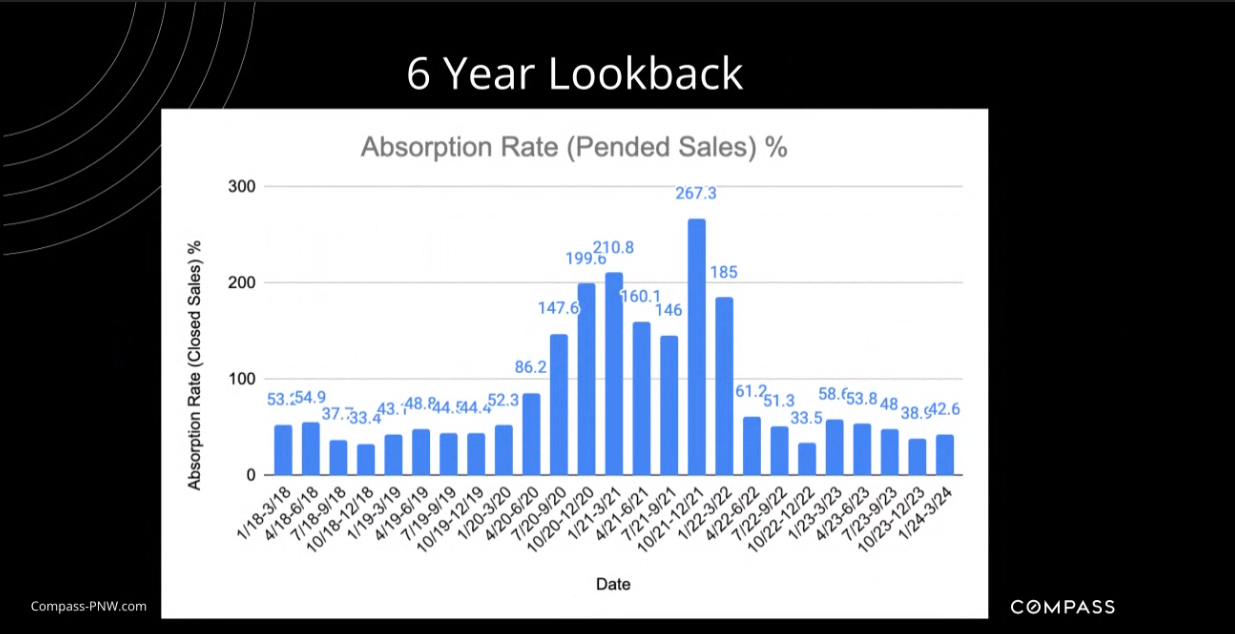

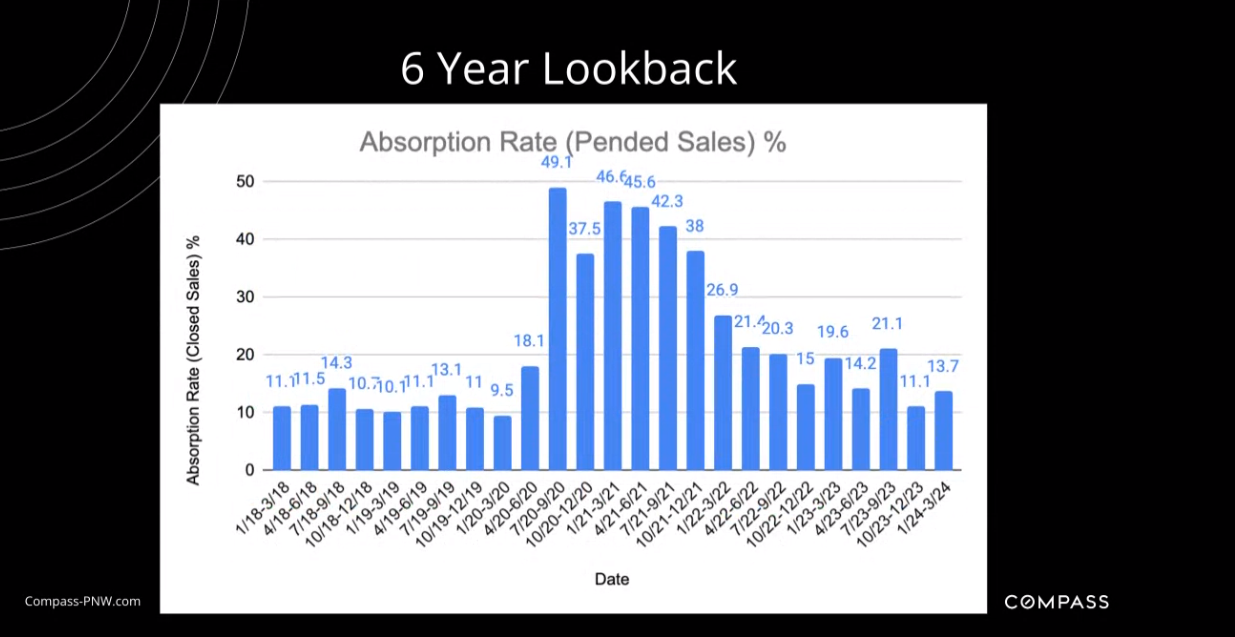

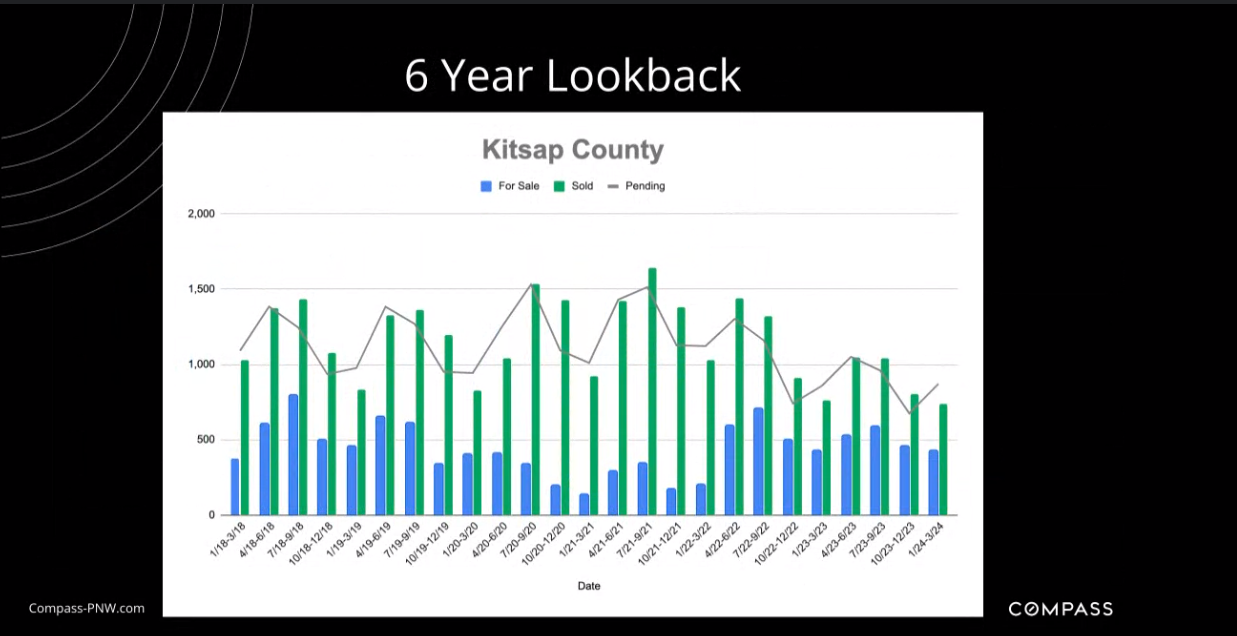

Inventory (NWMLS March): 1.57 months, up 13.9% YoY

(Buyer’s market is >6months; seller’s market is <6 months. Seattle is typically 3-4, 2020-2021 saw as low as 0.2 months of inventory)Median Closed (NWMLS March): $633,717 up over 43k YoY

MY FORECAST

Interest rates: Q1 Avg 7% (fluctuating 6.75-7.25%); Q2 6.5% (6.25-6.75%); 5.5% by end of Q4.

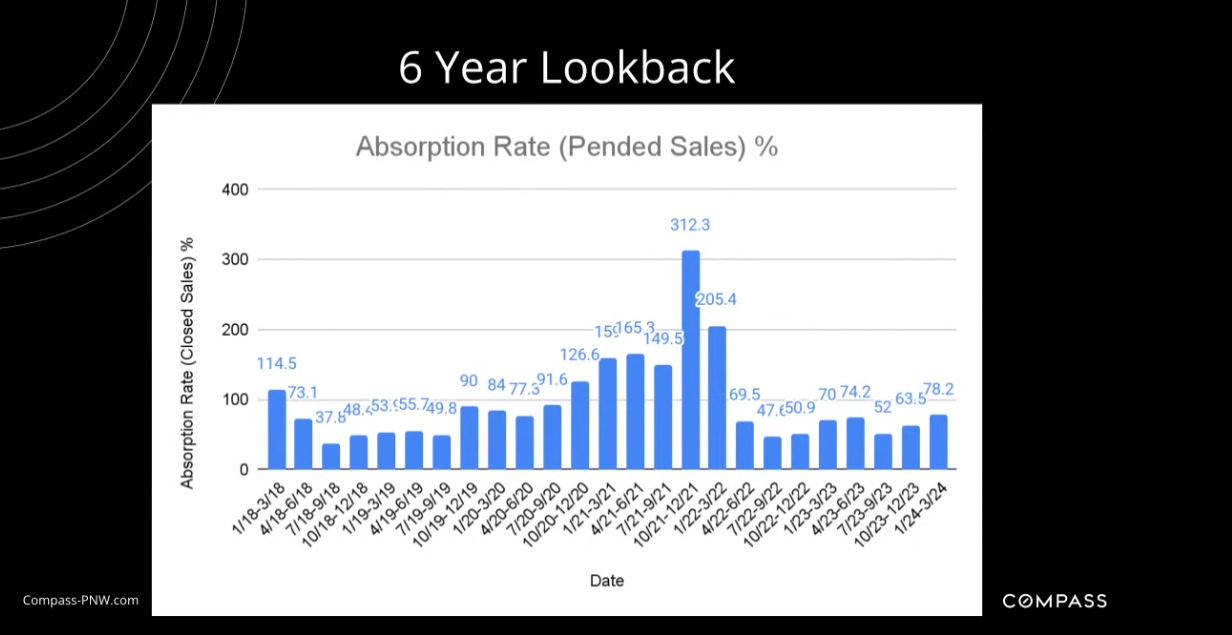

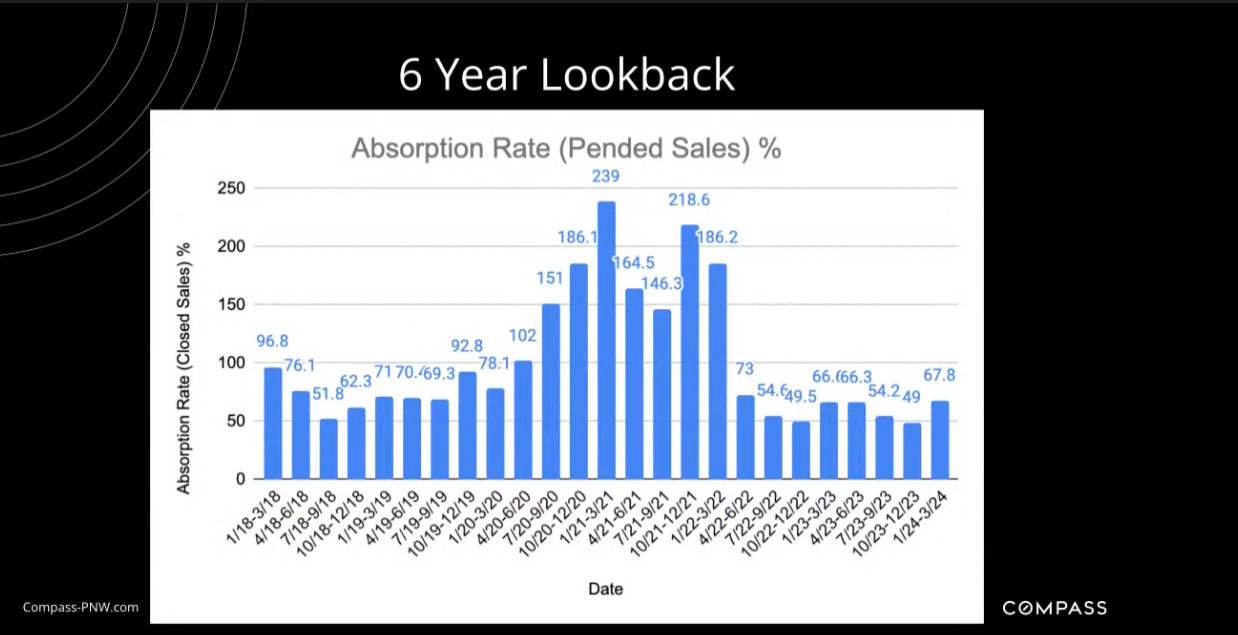

1% decrease in interest CAN roughly equal to 10% more borrowing power, which causes even a 0.5% fluctuation to affect buyer demand the week or two after the fluctuation.

Increase buyer competition in Q2/3

We will see widespread use of escalation clauses with promises to pay additional down in case of low appraisals or even waived financing in Q2/3 from the vast number of sidelined buyers, our growing population, and those new to the market in spring/summer. Buyer competition will taper off in Q4, but as always, so will the number of new and active listings every Oct-Dec. End of Q2/beginning of Q3, we will see more bully offers as well.

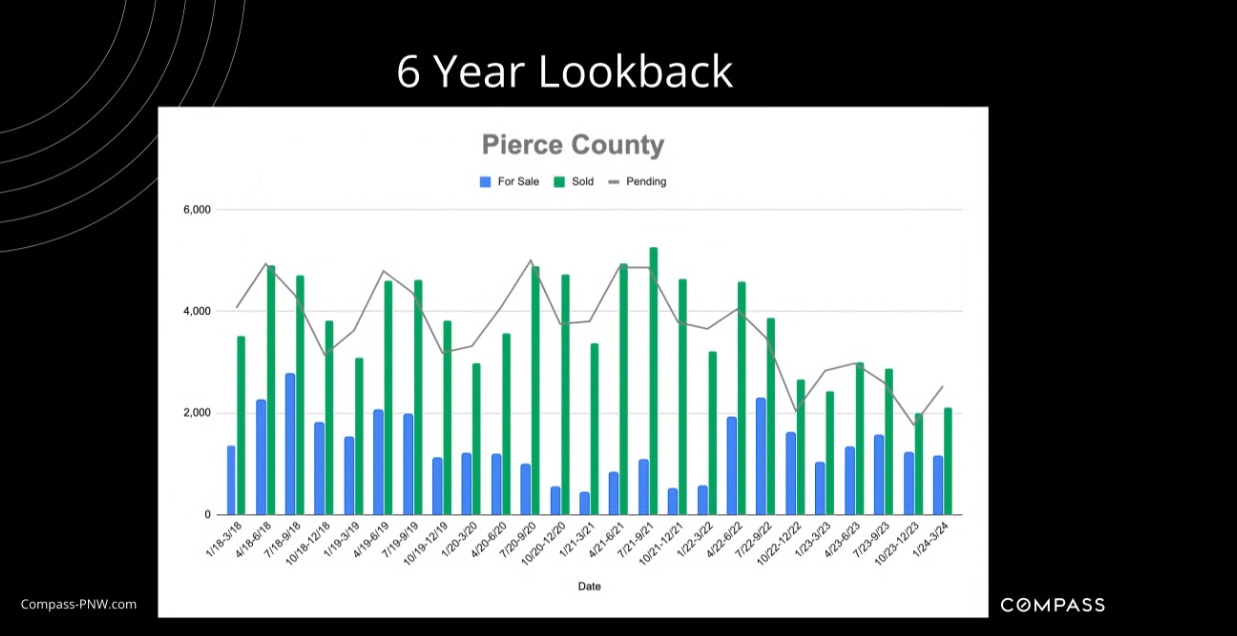

Continued low inventory for rest of decade

Minor bump in inventory in 2024 as more sellers will be more comfortable becoming buyers themselves with the lower interest rates and increased consumer confidence. All economists agree of not enough housing for at least several more years.

CURRENT INDUSTRY NEWS

Starting January 1, 2024, all buyers in Washington State are required to sign an agency agreement to receive advice from any real estate agents

www.brianhuie.com/agencylawCommissions and NAR: Ruling disallows NAR to force sellers to pay for buyer’s agent’s commission

NAR, along with two brokerage chains, lost an Antitrust lawsuit that stated NAR was forcing sellers to pay for the buyer’s agents’ commissions. NWMLS is not an NAR-affiliated MLS and has not forced sellers to pay a buyer’s agent’s commission. https://www.nbcnews.com/business/business-news/jury-finds-realtors-liable-inflating-commissions-rcna123149

NWMLS is a member-owned not-for-profit organization NOT an NAR-affiliated MLS. https://www.nwmls.com/about-nwmls/